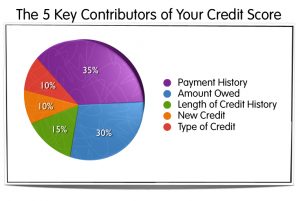

Your credit score and history is a key factor in receiving a mortgage approval. So, how is your score determined and what can you do to increase it.

Payment History:

Payment history accounts for the largest portion of the credit score at 35%. Late payments, and especially collections, have a negative impact on your credit score. And those late payments and/or delinquencies will remain on your bureau for 7 years so make sure you are paying on time.

Balance to Limit Ratios:

Your account balances also contribute to your credit score. You want to keep balances at or below 70% of the credit limit. Balances over this amount for extended periods will erode your score.

Length of Credit History

Think carefully before cancelling credit you’ve had for a long time, such as credit cards. The longer credit has been reporting, the better for your score as it shows well established credit patterns.

New Credit and Inquiries

New credit and many inquiries in a short period of time can decrease your score as it appears you are searching for more credit sources. Your credit will need to be checked if you are applying for a mortgage or financing. However, multiple checks for different types of credit are more concerning than multiple checks for the same type of financing, such as vehicle financing.

Type of Credit

Finally, having a balanced mix of different types of credit (credit cards, lines of credit, loans) will add more points to your score than having only one type of credit.

Checking your credit is an important part of the pre-approval process. It allows me to check for errors and provide advice, if needed, on improving your credit so you are in the best position possible to be approved for a mortgage.